Thanks to its strong performance since the start of the year, Bitcoin (BTC) is now within 20% of its last historical high (ATH). Will it continue to rise ? Let’s find out.

Bitcoin closes in on its 2021 ATH

Since the approval of spot Bitcoin ETFs by the Securities and Exchange Commission (SEC), BTC has been able to confirm the upward trend it began in 2023, to the point where the asset is now just 18.7% off its all-time high (ATH).

Since the beginning of the year, the price of Bitcoin has risen by around 34%, and by 9.4% over the last 24 hours, now trading at over $57,200 at the time of writing:

Bitcoin spot ETFs were among the factors behind the rise, with volumes reaching a record high, exceeding those of their first day of trading. These transactions totalled $2.4 billion on Monday, excluding Grayscale’s GBTC.

What can we expect now ?

It’s always difficult to estimate how far an asset’s price will rise once its ATH has been exceeded. Nevertheless, some clues can be found in the behavior of the previous bull run.

When BTC had surpassed its previous ATH in early December 2020, it had almost touched $65,000 the following April before correcting for the first time. This precise phase of the bull run corresponds to an advance of around 270%.

If we adopt the same logic between the previous halving in May 2020 and this first peak in April 2021, the increase this time is 692%.

However, while similarities can be observed between each cycle, they are never completely alike, and it would be relatively risky to mechanically carry over these figures to make forecasts. The famous stock market adage “past performance is no guide to future performance” should be borne in mind.

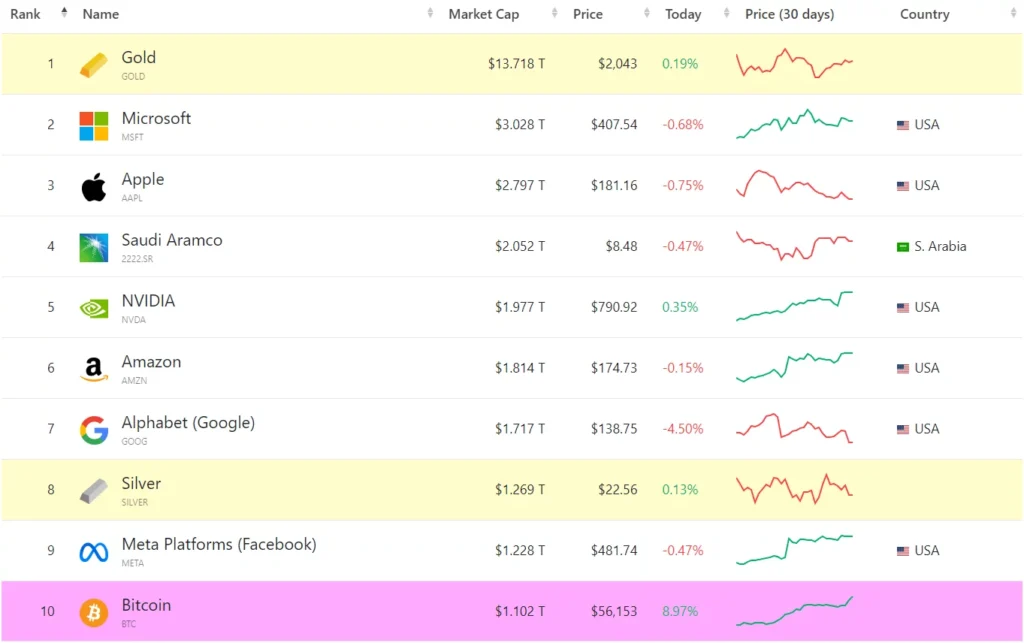

A look at the 10 largest market capitalizations in the world of finance puts things into perspective. Currently in 10th position, BTC has a capitalization more or less equivalent to that of Meta, but 12.45 times less than gold, the asset to which it is regularly compared:

While these observations seem positive, it’s important to remember that we haven’t developed a negative scenario. Admittedly, the past has shown that after every ATH overshoot and after every halving, the Bitcoin price continues to rise, but we can’t guarantee this.

Moreover, we must also bear in mind the possibility of a correction before reaching these 2 targets. What’s more, each cycle offers new scenarios, as illustrated by the fact that during the bear market of 2022, the BTC price fell below its ATH of the previous cycle for the first time.

Source : TradingView, Companies Market Cap