In a few weeks, the OVERDOME project will be releasing a new arbitrage trading product with flash loan. Before diving into the details of this launch, it’s crucial to understand what a flash loan is in finance. That’s precisely what we’re going to talk about in this article.

What is a flash loan in finance ?

For those unfamiliar, flash loan are a term specific to decentralized finance.

To put it plainly, it’s an immediate loan with no counterparty risk and no collateral, provided it’s repaid in a single transaction on Ethereum.

With this capital-free process, it is now possible to borrow without limit in order to find arbitrage opportunities in DeFi applications to generate immediate profit.

Flash loan applications

The instant loan, known as a flash loan, offers the possibility, in a single transaction, of :

- Borrow capital and use this money to buy an asset on a decentralized exchange A

- Resell this asset at a higher price on a B platform

- Pay off debt and interest

- Keep the cash flow once the terms of the loan have been met.

I would like to point out that for the transaction to be valid, capital must be borrowed and the debt discharged. In the event of errors or mishandling, the transaction is cancelled, and is less costly in terms of fees.

But not everyone can do it. It’s not as simple as it sounds.

Indeed, with the massive influx of new capital into decentralized finance, and the multiplication of security services, the operation can seem complex.

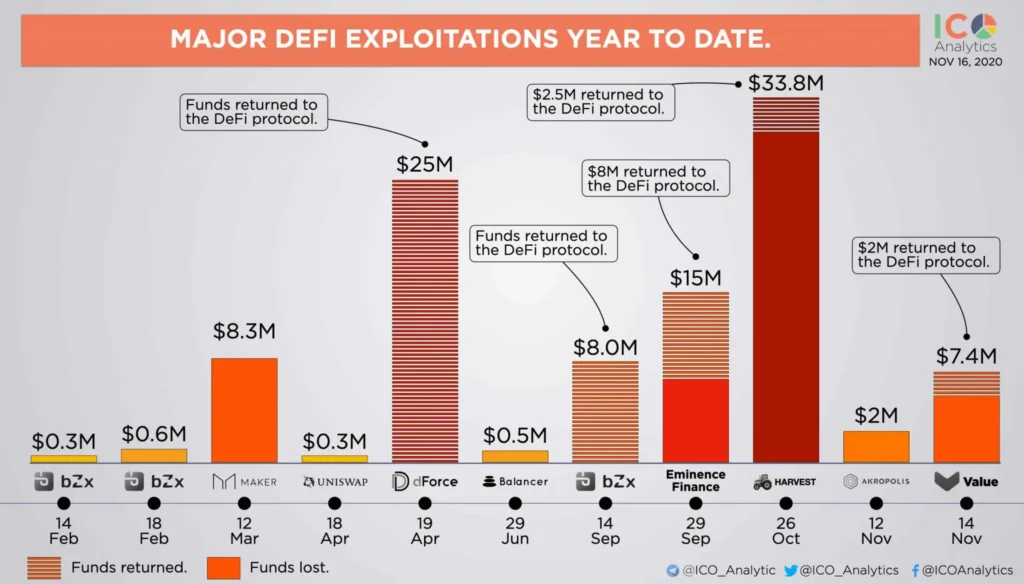

Harvest Finance, Akropolis and Eminence are proof of this. They lost several tens of millions of dollars 2 years ago, following flash-loan attacks.

Amazingly, in addition to a clear economic advantage, it’s possible to use the borrowed capital to carry out other actions, such as borrowing a governance token in significant proportions to overturn a vote that might be unfavorable to you.

The Harvest Finance story

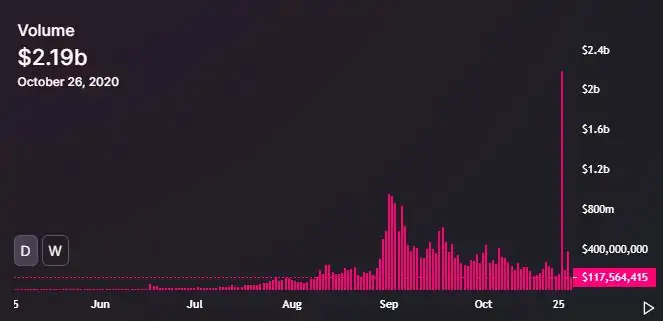

Harvest Finance was the victim of a flash-loan that generated a volume of $34 million.

Harvest Finance offers “Vault” investment products such as Yearn. By investing in an asset, smart contracts are called upon to automatically implement an investment strategy in order to generate a profit measured by an interest rate.

The impostor who carried out this attack deposited funds in this “Vault” on several occasions, then withdrew them in order to manipulate prices. Finally, he transformed these funds via decentralized exchanges, as detailed in the company’s public post.

Following the revelation of this attack, the price of the “FARM” asset automatically fell by 60%.

Flash-Loan: an effective software test

No lie, the Flash-Loan is an innovation.

Of course, we can judge any innovation morally, and thus contemplate the good it brings to the market, or in the opposite direction, regret it because of the damage it causes.

However, instant lending is a reality that cannot be denied today.

It’s easy to blame this instant borrowing system for causing financial losses for users and investors, when the fault should lie primarily with the developers behind the product and less with the users of the service.

There is considerable risk in using an immature, unaudited service. Remuneration for their use may be high, but it still reflects the project risk.

Passing the flash-loan test allows you to test the reliability of a service and separate the good from the bad. It’s a necessary evil, because today it helps to reinforce the standards of the decentralized finance sector, and to improve its resilience little by little through good practices or technical measures that protect against and prevent attacks.

Now that you know what a flash-loan is, I invite you to find out more about the OVERDOME project to understand the universe and anticipate the new product coming out in a few weeks’ time.

OVERDOME : Overdome : The revolution in the world of crypto-currencies and online gaming

I look forward to your comments

Leave a Reply