What is the BNB chain?

The BNB Chain is a multi-chain environment developed by crypto-currency exchange platform Binance. Binance’s economic power has enabled the development of this ecosystem, whose objectives are aligned with those of its parent company: to give access to crypto-currencies to a wider audience.

To achieve its objectives, BNB Chain relies on two blockchains: BNB Smart Chain and BNB Beacon Chain. While the former enables interoperability with the Ethereum (ETH) network and the deployment of smart contracts, the latter is dedicated to staking and governance within the BNB ecosystem.

The main crypto-currency in this ecosystem is BNB, which stands for Build and Build (formerly known as Binance Coin). Similar to ETH on the Ethereum blockchain, BNB is used to pay network fees and purchase certain products and services. In addition, as a Binance utility token, this crypto-currency also gives access to benefits on the platform founded by Changpeng Zhao.

Binance was launched on July 14, 2017, and quickly established itself as one of the world’s top crypto-currency exchange platforms during Bitcoin’s bull run in 2017. Since then, Binance has constantly introduced innovations and today has become the leader in its market.

As the BNB Chain has grown, so has Binance, while the BNB digital currency is recognized as the backbone of the exchange platform ecosystem.

It’s worth remembering that, while this multi-chain ecosystem enables high scalability and low costs, one of the three elements of the blockchain trilemma is inevitably overlooked: in this case, it’s the element of decentralization. Whereas the Ethereum blockchain has over 10,000 validators on its network, BNB Chain has just 29.

Despite this, BNB Chain remains one of the key players in Web3. Let’s take a closer look at how it works and the use cases for its crypto-currency, BNB.

The BNB Chain ecosystem

The BNB Chain ecosystem is a blockchain network created by the Binance platform to offer a complete infrastructure for decentralized financial applications (DeFi). The objective of the BNB Chain is to provide a scalable, secure and fast solution for decentralized financial transactions. The chain uses Binance’s native programming language, Binance Smart Chain (BSC), to enable developers to create decentralized applications that can interact with the blockchain. In addition, the ecosystem offers a wide range of services, such as crypto-currency exchanges, lending and borrowing, liquidity pools and much more. Thanks to its high performance and versatility, NBB Chain has become a popular platform for DeFi projects and continues to grow as a robust ecosystem for the future of decentralized finance.

Network architecture

In its early days, Binance launched its crypto-currency exchange platform without a blockchain. The BNB crypto-currency was an ERC-20 token, meaning it was issued on the Ethereum blockchain.

However, in April 2019, Binance unveiled the Binance Chain, its own blockchain designed to host its own tokens, as well as launch a decentralized exchange (DEX).

BNB has been converted from Ethereum to Binance Chain using the BEP2 standard, which is the token format for Binance’s blockchain. BNB has become the leading crypto-currency in this ecosystem. However, due to the rapid growth of decentralized finance (DeFi) on Ethereum, Binance launched the Binance Smart Chain in 2020 to create its own ecosystem of decentralized applications (dApps).

Over time, the Binance Chain was renamed the BNB Beacon Chain, while the Binance Smart Chain evolved into the BNB Smart Chain. These two blockchains have now been merged into a single entity: the BNB Chain.

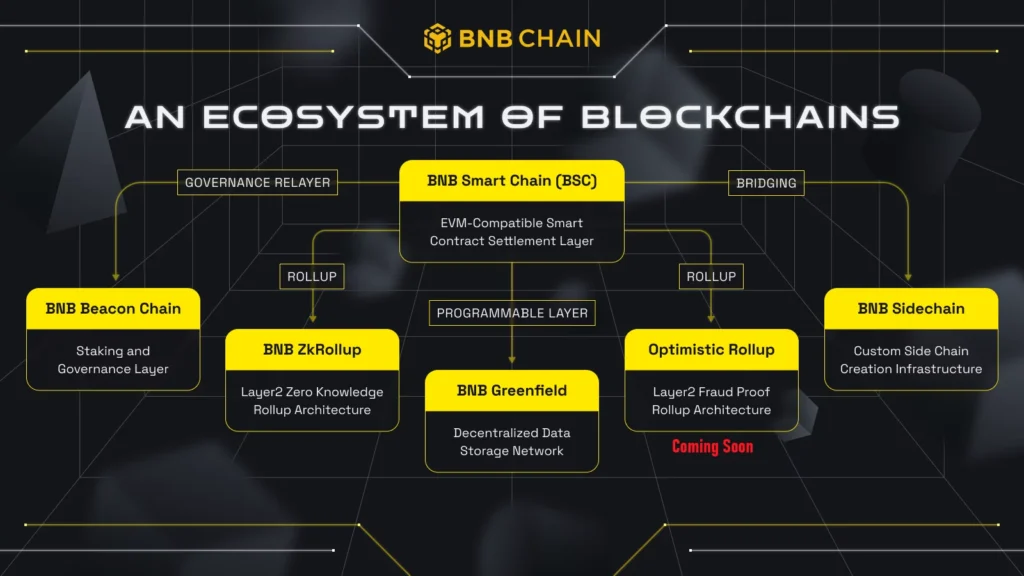

In addition to the two blockchains, BNB Beacon Chain and BNB Smart Chain, other entities have joined this ecosystem. Let’s take a look at the characteristics of these different components.

The BNB Chain is an ecosystem that is gaining in popularity in the crypto world.

Binance Coin (BNB) intelligent chain

The Binance Smart Blockchain (BSC) is at the heart of this ecosystem. Binance aims to prioritize interoperability between blockchains while integrating smart contracts into its ecosystem.

The native token chosen for the operation of BSC is undoubtedly the BNB. This allows holders of this token to engage in staking, as well as using it as fuel for smart contract execution, much like gas for Ethereum.

What’s more, the BSC is an Ethereum Virtual Machine (EVM)-compatible blockchain : as a specific part of the Ethereum blockchain code has been integrated into the BSC code, developers can easily move from one ecosystem to the other.

BSC benefits greatly from this advantage, as it attracts a growing number of users every day thanks to its low network costs compared to Ethereum. However, these lower costs on BSC are primarily attributable to its centralized consensus mechanism, which concentrates block validation power among a small group of participants.

There are a total of 29 validators in this network, and the consensus method used is proof-of-stake authority (PoSA). In this model, each individual holding BNB tokens must stake them, and the one who obtains the highest amount becomes a validator. Participants holding BNB tokens can also choose to delegate them to a validator or a candidate to obtain validator status.

Next, validators and candidates are ranked according to their BNB and the tokens they have been allocated : participants with the highest number of allocated tokens become validators, and can therefore participate in block production. These elections are renewed every 24 hours.

The speed of block production on the BSC is incredibly fast: whereas the Bitcoin blockchain (BTC) takes 10 minutes to distribute a block, the BNB smart chain is capable of producing a block every 3 seconds. The result is faster transaction security on the blockchain, which ultimately improves scalability.

Finally, through the use of BNB Chain, BNB Smart Chain is linked to multiple oracles to facilitate the execution of smart contracts based on real-world information. Among the oracles used are Binance, Chainlink, Band Protocol and Pyth.

Beacon chain for BNB

The BNB Beacon Chain (BC) was the first blockchain created by Binance, but it is outdone by the BSC ecosystem : while the BNB Smart Chain encourages the development of decentralized applications, the Beacon Chain was originally launched solely to exchange and create crypto-currencies via the now-closed Binance DEX.

The BNB Beacon Chain uses Cosmos’ Tendermint, a protocol that resists double-spending attacks and can tolerate up to one-third Byzantine actors. In addition, a minimum of 67% of validators must agree on a block for it to be considered valid. If no consensus is reached, the Tendermint protocol shuts down to prevent forks and cyber-attacks from damaging the system.

It should be noted that this network’s consensus method is also known as Proof-of-Staked Authority. According to the Beacon chain’s genesis code, the maximum number of validators allowed is 21. However, at the time of writing (February 2023), there are currently only 11 entities serving as validators.

Following user requests, the maximum number of validators may soon be increased from 21 to 100, including the two future validators for BC and BSC.

It’s worth noting that the consensus method is not the only feature shared by the two blockchains. As they are both run by the same entity, they constantly communicate with each other.

The BNB Beacon Chain and the BNB Smart Chain share many similarities and data exchanges, particularly when it comes to the tokens created in their ecosystems. Moreover, this communication is essential to ensure the smooth running of the BNB Chain’s cross-chain architecture.

ZK Rollup, Sidechain, and Greenfield

The three concepts of ZK Rollup, Sidechain and Greenfield are often discussed in the field of blockchain technology. Here, we compare and contrast these three approaches to better understand their potential impact.

Over time, BSC developers have recognized the need to improve the network’s scalability in order to accommodate a growing number of users without causing congestion on the blockchain and witnessing an increase in transaction fees. To solve this problem, Binance is considering two solutions : Sidechains and ZK Rollups.

The BNB Sidechain, launched in 2022, is a collection of smart contracts that allows developers to deploy their own blockchain with unique features, nodes and validators, while remaining connected to the main BNB Smart Chain architecture.

One of the most important projects under development is BNB Greenfield, part of the BNB Chain ecosystem. Its aim is to “unleash the power of decentralized blockchain and storage technology for data and the data economy”. One of its key assets is decentralized data storage.

Key figures for the BNB intelligent chain

A look at the crypto-currency market reveals that BNB is one of the top 5 most valuable assets. In February 2023, its market capitalization stood at $50 billion, and it proved more resilient to market downturns in 2022 than bitcoin (BTC), according to current data.

By February 2021, Binance’s smart chain had recorded more daily transactions than Ethereum, and by the end of 2022, its unique addresses had surpassed those of Ethereum.

Interestingly, Ethereum’s strategy focuses on the development of decentralized finance, while the BSC blockchain aims to extend its network to the general public. Here are some statistics on the BNB smart chain (February 2023):

- Every day, there are 932,000 active addresses.

- 257 million unique addresses have been created.

- There are 3.2 million transactions per day.

- The average price of gasoline is estimated at 7 gwei.

As for the applications deployed on the network, they number around 300, with more than 10 daily users. Among the most popular are the decentralized stock exchange PancakeSwap and the DEX aggregator 1inch Network.

The BNB and its ICO

BNB, a type of crypto-currency, was created in a fundraising event known as Initial Coin Offering (ICO), which ran from June 26 to July 3, 2017. This occurred 11 days before the launch of the Binance exchange.

Initially, the BNB was issued in the form of ERC-20, which operated on the Ethereum network standard. The total token offering reached 200 million. For this ICO, the issue price was 1 ETH for 2,700 BNB and 1 BTC for 20,000 BNB.

During the ICO, Binance issued a total of 100 million BNB, which were sold at a unit price of $0.1. The remaining 50% was split between the founders (40%) and private investors (10%).

The return on investment was impressive for the first BNB holders. In just 6 months, BNB’s value increased 200-fold, reaching almost $22 in January 2018.

Binance’s ICO quickly attracted community attention and helped the exchange establish itself. Meanwhile, BNB has become widely recognized as the ultimate utility token.

What is the BNB token used for?

There are many uses for the NBB, and they are multiplying over time. However, the majority of investors only obtain it to reduce their costs when trading on Binance. Let’s take a closer look at all NBB use cases.

Binance cuts transaction fees

Active users on Binance, a cryptocurrency exchange platform, can benefit from additional discounts on transaction fees by reaching VIP rank. These discounts depend on the volume of transactions carried out and the number of BNB in their possession.

To be recognized as a VIP, you need to own a minimum of 25 BNBs and carry out transactions with a volume of $1 million or more over the last 30 days. There are 9 VIP levels, offering progressively higher discounts:

Contact IEO Binance

Similar to Initial Coin Offerings (ICOs), Initial Exchange Offerings (IEOs) enable projects to raise funds via tokens, with the difference that they take place on exchanges. Binance has its own platform dedicated to crypto-currency projects, called Binance Launchpad, which is specifically designed for IEOs.

To take part in fundraising on this platform, you need to own BNBs on the exchange. These Initial Exchange Offerings (IEO) are divided into 4 phases:

Calculation of BNB ownership: During the initial phase, Binance calculates the quantity of BNB you own to determine your level of participation;

Subscription: This is when users can buy tokens with their funds;

Calculation: At this stage, Binance determines the number of tokens to allocate to each investor;

Distribution: The period during which investors receive the tokens they have purchased in their portfolio.

Referral fees

Binance’s referral opportunities allow you to increase your earnings by holding BNB. Users who refer new registrants to Binance can receive a commission for every transaction they make. What’s more, when a referrer shares their invitation link, they have the freedom to choose how their commissions are distributed.

In particular, they can choose to share a portion of the commissions earned on their invited friends’ transaction fees. Referrers have the option of determining sharing rates as follows:

If the referrer’s average daily balance is less than 500 BNB and his basic discount rate is 20%, he has the option of sharing 0%, 5% or 10% with the friends he invites.

If the referrer’s average daily balance is over 500 BNB and his basic discount rate is 40%, he has the option of sharing 0%, 5%, 10%, 15% or 20% with the friends he invites.

Procedure for burning tokens

In 2017, a total of 200 million BNB were released on the Ethereum blockchain in the form of ERC-20 tokens. In addition, BNB creators have committed to gradually destroying half of the tokens over time.

The aim of this process is to progressively decrease the number of BNB in circulation in order to increase their rarity. The main idea is to drive up the price of BNB over the long term.

Binance has undertaken to devote 20% of its quarterly profits to purchasing BNBs on the market and destroying them in an operation known as a “burn”, which entails the definitive elimination of a certain number of BNBs in circulation.

Nevertheless, in 2021, two updates were implemented to modify token burn conditions. The October 22, 2021 update saw Binance use part of the network fees collected from the BNB Smart Chain to burn them automatically. Two months later, the BNB Chain replaced its manual mechanism with an “automatic burn” calculated according to the number of blocks generated and the BNB price.

At the time of writing (February 2023), only 157,000,000 BNBs remain in circulation.

Binance team and partners

The BNB Chain team

The people responsible for creating and maintaining the BNB chain are not publicly known. Documentation relating to BNB and the operation of the BNB chain focuses solely on the technical aspects of its ecosystem.

However, the key player in this ecosystem is none other than the renowned Changpeng Zhao (CZ), CEO and principal co-founder of Binance, as well as a fervent advocate of the mass adoption of crypto-currencies via the BNB blockchain.

It’s worth mentioning that Yi He, co-founder of the group, also plays an important role in Binance’s development. She holds various positions such as Director of Customer Service and Binance Labs.

Collaborations

As the popularity and success of the Binance crypto-currency platform is directly linked to the BNB blockchain, this blockchain benefits from the network and operations run by its parent company. In addition, every time Binance organizes a campaign, the BNB blockchain is indirectly promoted.

Binance’s list of partners is extensive and continues to grow, in parallel with the various applications of its blockchains. These range from payment platforms to the sports industry, education, security and technology. Binance is actively seeking international collaborations to expand its user base.

One of Binance’s main attractions is its involvement in the sports industry. Starting in 2020, the company has partnered with startup Chiliz to promote fan tokens through its Launchpad platform. These fan tokens, originally created by soccer clubs, are designed to boost fan engagement and give them access to innovative services.

One of the most impressive campaigns in the world of sport is Binance’s partnership with professional footballer Cristiano Ronaldo.

In the run-up to the 2022 World Cup in Qatar, a renowned international personality unveiled a series of non-fungible tokens (NFT) bearing his likeness, now available on Binance’s NFT marketplace.

Binance recently announced a partnership with Canadian singer The Weekend for his “After Hours Til Dawn” world tour, while forming a strategic alliance with YG Entertainment, the South Korean music label that includes popular bands such as Blackpink and BigBang. In addition, the company was the official partner of the 64th Grammy Awards, reinforcing its presence in the world of celebrity and entertainment.

Some collaborations focus on the Web3 universe. In 2020, the Brave browser added a new feature making it quick and easy to use Binance through the addition of a widget. Two years later, a similar feature was created thanks to a partnership between Binance and Ledger, enabling users to buy crypto-currencies via the Ledger Live interface.

Finally, the international company is looking to make its mark in the world of video games by signing an agreement with Netmarble F&C, a South Korean mobile game developer with a market capitalization in excess of $5 billion. This partnership aims to promote the creation of applications on the BNB Smart Chain linked to the gaming industry.

Competitors

As BNB Chain is linked to Binance and the BNB utility token, it could suffer repercussions linked to competition between exchanges and their underlying crypto-currencies. Indeed, several major platforms own their own crypto-currencies and blockchain in order to provide exclusive services to their customers.

Below is a non-exhaustive list of competing exchange platforms, along with their associated crypto-currencies and blockchains:

- Coinbase and its Layer 2 Base solution

- Huobi and its HECO Chain blockchain (HT)

- Kraken

- Crypto.com and its Cronos blockchain (CRO)

- OKX and its OKX Chain blockchain (OKB)

- KuCoin and its KuCoin Community Chain (KCS) blockchain)

- Bybit

- Bitfinex

At the time of writing, in February 2023, none of these exchanges has developed a blockchain as widely used as the BNB chain.

Despite Binance and BNB’s dominant position relative to other companies, particularly after the fall of FTX and its FTT token, the company remains vulnerable and at risk of being toppled by one of its powerful competitors in the years to come.

How do I acquire BNB tokens?

There are several cryptocurrency platforms that offer BNB purchases, such as OKB, KuCoin and Huobi. However, if you opt for these exchanges to buy your BNB, you won’t be able to benefit from the advantages offered by this token on Binance.

In addition, we recommend that you buy BNB on the Binance exchange platform in order to benefit from numerous advantages, such as lower transaction fees, the possibility of investing in IEOs on the Binance Launchpad, and the use of applications accessible via the BNB Chain.

To buy BNB :

- Register with Binance.

- An email will be sent to you and you will need to click on a link to verify your account.

- Deposit euros on the platform.

- Click on the Market menu and search for the EUR/BNB pair.

- You can now buy it for the amount of your choice.

- Congratulations, you now own BNB. You now own BNB.

How do you keep your BNB?

If you wish to store your NBBs outside the Binance exchange, the optimal solution is to choose a hardware wallet. This type of wallet offers you total security for the storage of your BNB, as it is stored offline and protected against cyberattacks.

In addition, it’s worth mentioning that you have the option of buying your cryptocurrencies directly via the Ledger Live interface, thanks to its partnership with Binance. This way, your NBB and other crypto-currencies are stored in a single, secure location. The best wallet on the market is the Ledger Nano S Plus.

My opinion of BNB Chain and BNB

It was powered by Binance, leveraging the strengths of its parent company to grow rapidly and reach the top 3 most widely used public blockchains in the world.

One of the main strengths of the BNB blockchain lies in its scalability, where the cost of a transaction is significantly lower than on Ethereum. This is made possible by the centralization of block validators, who are selected according to the amount of BNB they possess. As it is not decentralized, users have only limited influence on future transactions carried out by BNB Chain.

As the BNB is considered the central element of the BNB Chain ecosystem, a decrease in its value could lead to a reduction in interest in the network.

Despite this, BNB remains attractive to users as it offers various advantages such as reduced transaction fees on Binance, access to exclusive tokens on Launchpad, and its use on different blockchains within the exchange. This crypto-currency enables a wide range of uses, and its value can potentially increase over time thanks to the combustion mechanism.

On the one hand, the BNB blockchain can count on its parent company’s many partnerships to promote its activities worldwide. In its efforts to democratize on a large scale, ZK Rollups are the next technologies to be implemented in order to encourage mass adoption.

Nevertheless, these ubiquitous connections between the BNB Chain, the Binance exchange and the BNB token could also lead to certain problems. Should Binance encounter legal or financial difficulties, it is possible that the BNB Chain could experience a slowdown.

What do you think of this cryptocurrency?

Sources : Figures 1 and 2 – BNB Channel Overview, Figure 3 – Binance Blog Featuring Cristiano Ronaldo’s First NFT Series Launch, Figure 4 – Binance Trading Fee Schedule_.