Bitcoin continues to soar, surpassing the $60,000 mark for the first time since November 2021. Currently above $61,000, it looks on course to surpass its all-time high of $69,044. Thanks to Bitcoin spot ETFs?

Bitcoin continues its never-ending rise

Who said $60,000 was resistance for Bitcoin, which has posted a gain of almost 20% over the last 7 days ? For the first time since November 2021, BTC has surpassed the symbolic $60,000 threshold.

In other words, it still has less than $10,000 to climb before beating its all-time high price of $69,044. This milestone had been reached on November 10, 2021, before the king of cryptocurrencies fell and was swept away by the successive bankruptcies of Three Arrows Capital (3AC), Silvergate Bank, Celsius, FTX and many others.

But since then, Bitcoin has risen again, not only breaking through the $60,000 ceiling momentarily, but now even topping the $61,000 mark.

Naturally, such a sudden rise did not spare traders. Over 330 million dollars were liquidated in the last 24 hours, including 202 million dollars in short positions.

It’s worth noting, however, that Bitcoin is climbing almost unilaterally, leaving the altcoin market behind.

A rather rare specificity, which can be attributed to the success of Bitcoin spot ETFs, which are breaking their daily volume records by the day, with BlackRock and its IBIT ETF leading the way. Indeed, the giant exceeded $1.3 billion in volume alone yesterday.

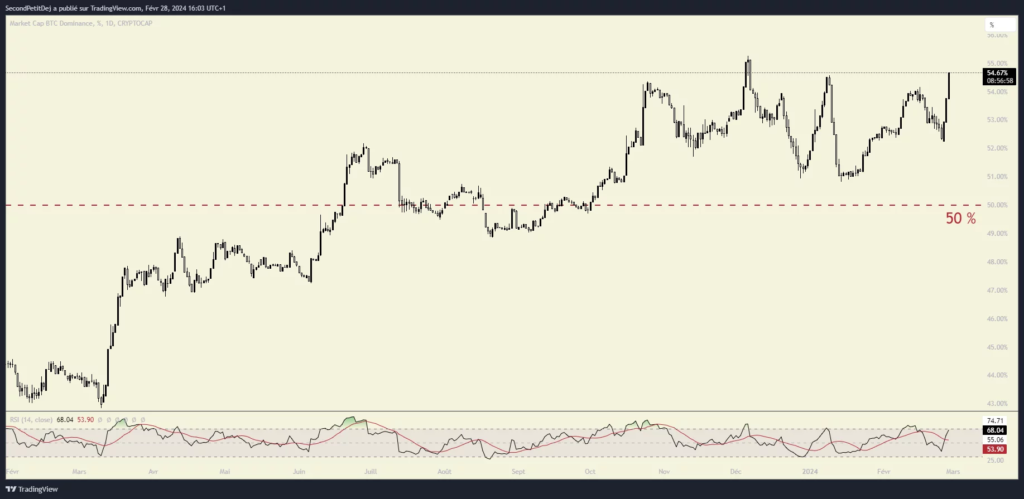

In this respect, Bitcoin’s dominance has been particularly noticeable since Monday, as it has continued to rise ever since, and now stands at 54.7%. We can thus observe that altcoins have indeed been lagging behind in recent days:

Aside from the momentum around ETFs (which total $45.6 billion under management in the form of BTC), some analysts attribute this momentum to investors’ anticipation of Bitcoin’s rise due to halving, which is due to occur during April next year.

However, Bitcoin spot ETFs appear to be leading the way. According to a study recently published by CryptoQuant, around 75% of new investments in BTC come from new ETFs issued on US exchanges.

In the same vein, in an interview with Bloomberg, Sergey Nazarov, co-founder of the Chainlink oracle network, declared the approval of Bitcoin spot ETFs a “watershed moment”.

In particular, this institutional push would justify the virtual absence of new retail investors in the crypto market, as evidenced, for example, by the non-existence of any rise in the keyword “Bitcoin” on the world’s most widely used search engine, Google, especially in comparison with the bull run of 2021.

For the record, Glassnode pointed out this afternoon that, since its inception, Bitcoin has only seen 31 days above the $61,000 threshold.

Are we witnessing a turning point in the history of the king of crypto-currencies, with Bitcoin being driven by institutional investors ? Contradictory as it may seem, it would appear that this is indeed the case.

Let me know what you think in the comments !👇

David

Sources : TradingView, Dune