While disinflation in the U.S. has clearly resumed, it seems that the Federal Reserve (FED) wants to be artificially pessimistic, certainly out of an abundance of caution. While we await Bitcoin’s bull run, here are the two technical situations we can envisage ahead.

Lower inflation an encouraging sign for the market

The FED adopted a monetary status quo this week, leaving the Fed funds rate at 5.5%. However, it mainly updated its macroeconomic forecasts and, rather surprisingly, raised its inflation forecasts.

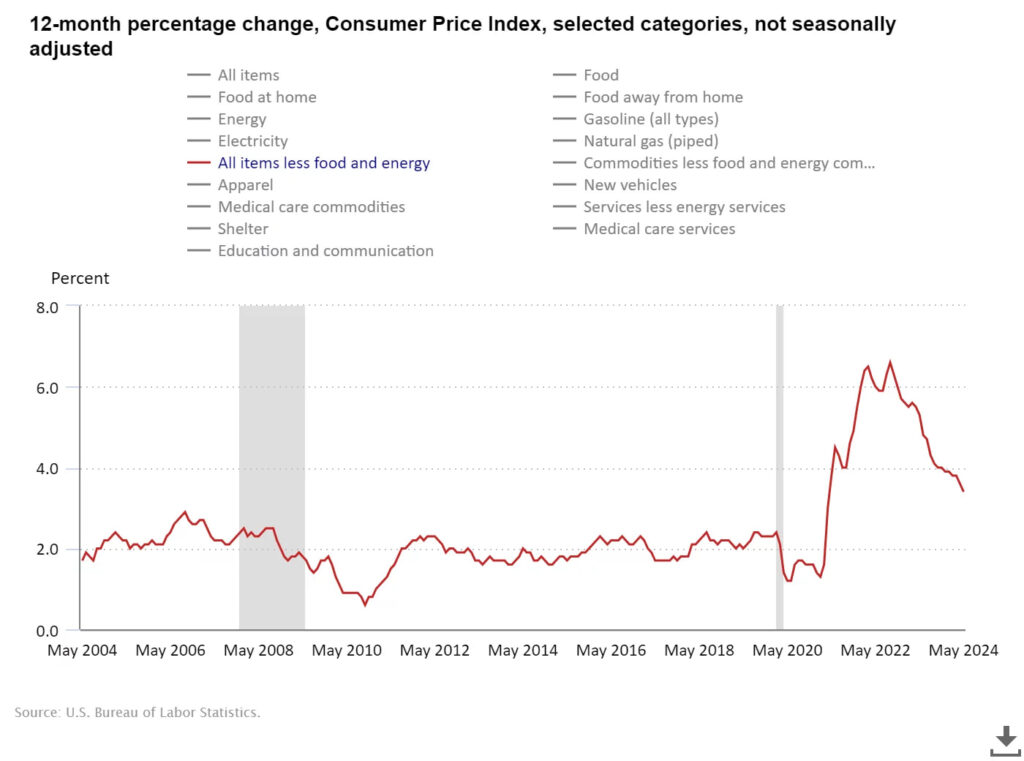

This is very surprising, given that June saw the reactivation of disinflation in the United States according to the underlying PCI inflation index, putting an end to 3 months of uncertainty. While all the leading inflation indicators are encouraging, it seems that the FED is seeking to adopt a cautious approach, no doubt to assess market tensions.

And that’s because it seems he doesn’t want to give in to the Fed’s surface pessimism, when underlying disinflation has picked up and the US unemployment rate has just hit 4%, according to the latest NFP report.

However, let’s not lose hope, as the FED is very open to one or even two rate cuts this year. But everything can still change very quickly, especially if the underlying PCE inflation index at the end of June is favorable. Which is currently the case.

The FED has a meeting scheduled for September 18, and I remain convinced that we will see several rate cuts between now and the end of the year.

I can assure you that the crypto queen’s bull run will begin several weeks before Christmas, so be prepared.

2 possible situations before the bull run

With an ATH of $73,700 on March 13, the Bitcoin price is developing a sideways transition phrase between $56,500 and $72,000.

A majority of novice traders are worried about this situation, and some even believe that it’s already the end of the bull cycle.

You can rest assured that we are more than 50 days away from the final halving. We’re getting closer and closer to the start of the bull run, i.e. the vertical uptrend that will see BTC break through its all-time record and initially rise towards $90,000.

In the meantime, 2 situations are possible :

- A second test of $60,000 (200-day exponential moving average), which would be the last opportunity to enter BTC at low prices before the bull run;

- An immediate rebound to the 50-day moving average and the start of the bull run during the summer.

Leave a Reply