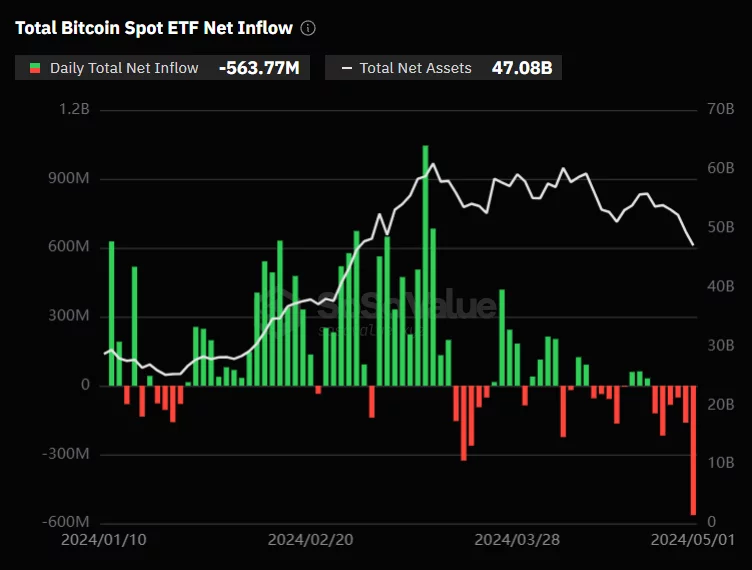

A net amount of $564 million was withdrawn from spot Bitcoin ETFs in the United States on May 1, marking their worst day since launch.

A decline in interest for spot Bitcoin ETFs

On May 1, spot Bitcoin ETFs experienced total outflows of $563.7 million. According to SosoValue data, this is the largest outflow recorded since their launch in January 2024.

Fidelity’s FBTC ETF saw the largest net outflows among the various spot Bitcoin ETFs, with over $191 million withdrawn from the fund. This amount even surpasses the $167.3 million outflow from Grayscale’s GBTC.

ARK Invest’s spot Bitcoin ETF (ARKB) recorded outflows of $98.1 million, ranking as the third-largest net outflow of the day, followed by BlackRock’s IBIT ($36.9 million) and Bitwise’s BITB ($29 million). Notably, this is the first time BlackRock’s spot Bitcoin ETF has recorded a net outflow.

Thus, with the exception of Hashdex’s ETF (DEFI), all American spot Bitcoin ETFs recorded net outflows on Wednesday, June 1, 2024.

Enthusiasm for spot Bitcoin ETFs appears to have waned, at least temporarily. April’s monthly outflows reached $343.5 million, ending a three-month streak of positive net inflows.

Grayscale’s GBTC ETF leads the outflows for April, with $2.5 billion in outflows.

BlackRock : A first outflow recorded on the iShares Bitcoin Trust

BlackRock’s iShares Bitcoin Trust, the best-performing spot Bitcoin ETF in the United States, saw a net withdrawal of $37 million on Wednesday, marking its first net outflow since its launch in January.

This withdrawal is part of a broader trend of disinvestment in spot Bitcoin ETFs and can be explained by several contextual factors.

On one hand, the prospect of the U.S. Federal Reserve (FED) keeping interest rates high for longer puts pressure on risky assets. The rising cost of money reduces the appeal of speculative investments and encourages investors to turn to more stable assets.

Bitcoin’s inherent volatility has caused a growing discount relative to the net asset value of some American portfolios. These discounts, indicating the gap between the ETF’s price and the actual value of the underlying Bitcoins, may deter some investors who worry about not buying Bitcoin at a fair price.

It’s worth noting that this withdrawal does not necessarily indicate a fundamental trend reversal for Bitcoin and its associated ETFs. Also, this difficult day for spot Bitcoin ETFs aligns with a significant drop in BTC’s price.

👉 Read also – Bitcoin records its worst month since the FTX collapse

The future of spot Bitcoin ETFs will likely depend on the broader cryptocurrency market’s evolution. If Bitcoin can overcome its current challenges, the ETFs backed by it could experience significant growth in the coming years.

At present, BlackRock’s iShares Bitcoin Trust retains a net invested amount of over $6 billion.

Source : SosoValue

Leave a Reply