While the Bitcoin price surpassed its all-time high of $69,000 at the very beginning of the week, the altcoin season has yet to get underway, while BTC’s dominance continues to grow. When the altcoin season is fully underway, how will we know which altcoins can and cannot move up to their respective ATHs?

Altcoin price and market capitalization, the key is here

For the first time in its young history, the Bitcoin price has reached its all-time high several weeks before BTC’s halving. The next reduction in the mining premium will take place around April 15 and, in the past, BTC has accelerated upwards towards its ATH in the weeks following halving.

The Bitcoin price is therefore ahead of its usual cycle, and the reason for this advance is well known: the Bitcoin Spot ETFs continue to record daily inflows. BlackRock now holds over 200,000 Bitcoins – that’s huge, and it’s only the beginning.

This ETF parameter will also have the effect of delaying the altcoin season, prolonging the bullish trend of BTC dominance for a few more weeks. But we’re already in a mini alts season, with many tokens having technically validated their long-term bullish reversal.

So now is the time to build up a bag of cryptos to make sure you’re on board when the altcoin season kicks off.

Then, how do you know which tokens can or cannot join their respective ATH? You need to distinguish between the price of a token and its market capitalization (market cap = number of tokens in circulation * token price).

If an altcoin’s supply has risen sharply compared with the previous bull run, then it will be less likely for the token to join its ATH.

In order to compare what’s comparable from a technical point of view, you ideally need a token supply that’s fairly close between the 2021 and 2024 bull cycles. The best option is therefore to carry out a market cap analysis for each token.

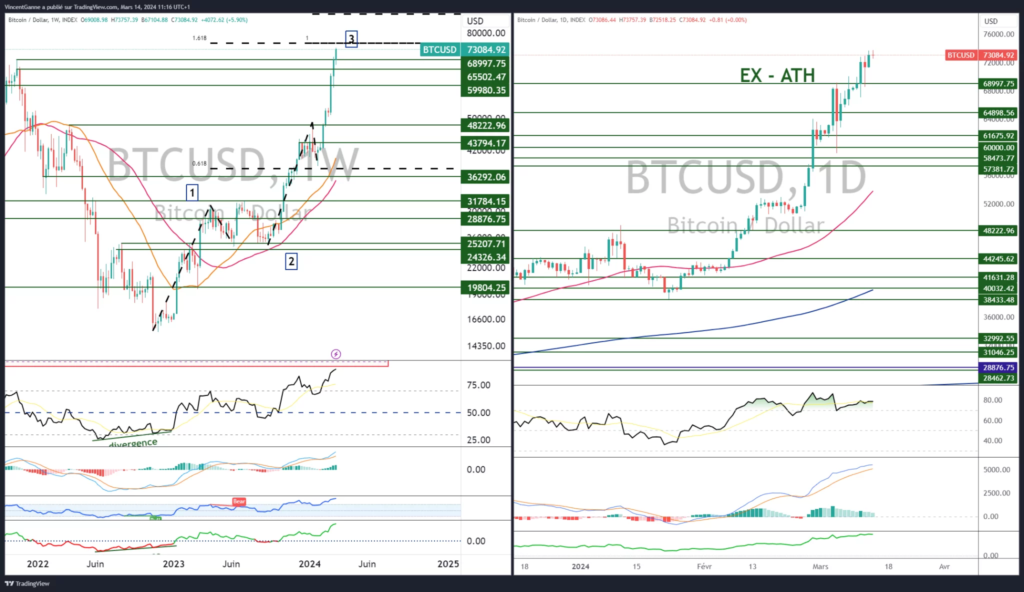

Bitcoin, the technical challenge of preserving the ex-ATH

A quick word on Bitcoin to conclude. The market surpassed its former all-time high at the very start of the week, and the challenge now is to preserve the new US$69,000 support to further develop the uptrend towards the next theoretical resistances.

If, on the contrary, BTC were to reintegrate its ex-ATH, then a major correction would take place at around 60K.

David Crypto.