Bitcoin records its worst month : After several months of impressive performance, Bitcoin experienced its toughest month since the FTX collapse, recording a significant decline of 14.93% in April 2024. This setback signals a pause in the market euphoria and reminds investors of the short-term volatility of cryptocurrencies.

An intense start to 2024 for Bitcoin

Since its lowest point, Bitcoin’s price has shown performances that seemed unimaginable just a few months earlier. After a 2022 filled with dramatic events, including the collapse of major ecosystem players like the Terra (LUNA) blockchain, the Celsius and FTX exchanges, and a 77% drop over the course of 12 months, many investors had lost hope.

However, Bitcoin’s anti-fragility characteristics allowed it to emerge stronger from these trials, climbing from $15,400 at its lowest point to over $73,000 in March 2024.

In September 2023, BTC’s price began a steep ascent, using the $25,000 support to soar beyond its previous all-time high (ATH).

Likely driven by institutional demand, particularly due to Bitcoin spot ETFs—a financial product allowing exposure to the value of BTC without directly holding it—the market may have become a bit too optimistic over a short period, leading to a pause lasting several weeks.

Bitcoin spot ETFs quickly attracted new investors, setting numerous records. Since their approval in January 2024, more than $12 billion in net inflows have been recorded, with a record-breaking day on March 12, reaching over $1 billion in net inflows.

April, Bitcoin’s worst month in a year and a half

Unfortunately, such dynamics rarely last for more than a few months. Thus, the peak at $73,750 marked the beginning of a correction in Bitcoin’s price, with a total drop of 23% down to its recent low of $56,500.

April ended with a 14.93% decline, marking the worst month for Bitcoin since the collapse of the FTX platform in November 2023, which saw a 16.24% drop.

👉 Also in the news – MicroStrategy buys (Again) $8 million worth of Bitcoin

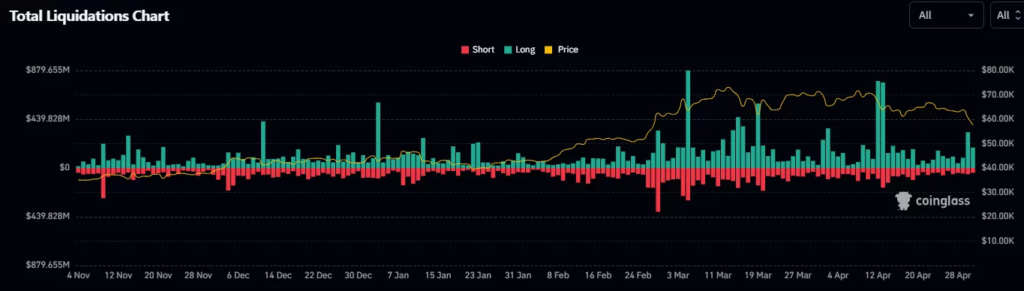

This recent decline has led to the liquidation of nearly $400 million across all cryptocurrencies over the past 24 hours, totaling several billion dollars in liquidations throughout April 2024.

Taking a step back, it’s clear that this recent decline is relatively minor compared to Bitcoin’s performance since the beginning of 2023, and the drop from $73,000 to $57,000 doesn’t significantly impact long-term investors.

Finally, this drop has helped cool the euphoria in the cryptocurrency market, causing the Fear and Greed Index to fall to a score of 54 out of 100.

Source : TradingView, Coinglass

Leave a Reply