The Crypto Fear and Greed Index, is a financial indicator that measures the general sentiment of an asset, usually Bitcoin. It is used to assess whether investors are acting in greed for gains or in fear of losses.

How does this index work to help better understand investor behavior ?

Can it help to make informed decisions ?

How does the Crypto Fear and Greed Index work?

Bitcoin is primarily associated with the Crypto Fear and Greed Index, as it is the leading cryptocurrency in terms of market value and influences the entire market in terms of price fluctuations. In this article, we’ll look at how this index works and why it’s so important, through the prism of the Bitcoin Fear and Greed Index.

The Bitcoin Fear and Greed Index is an index based on a combination of 5 different data sources.

Each piece of data is constantly evaluated, day after day, to detect any noticeable change in sentiment between different periods.

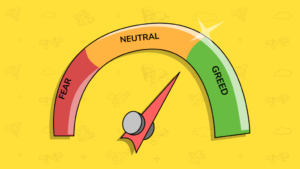

The barometer rates emotions of fear and greed in the market on a scale of 0 to 100.

The index will reflect “Extreme Fear” when it ranges from 0 to 25.

When it ranges from 25 to 45, the index will show “Fear”.

For the range of 45 to 55, the index will display “Neutral”.

In the range of 55 to 75, the index will indicate “Greed”.

And when it is between 75 and 100, the index will reveal “Extreme Greed”.

On September 15, 2023, the Bitcoin Fear and Greed Index was published.

The Bitcoin Fear and Greed Index is calculated as follows.

1. 25 % of the index is based on the fluctuation of Bitcoin (BTC)

The index compares the current volatility and decreases of the Bitcoin price with the averages of the last 30 and 90 days. This helps to distinguish between a sudden period of volatility and a period of high volatility that follows another.

An unusual increase in volatility coupled with a decrease in the price of Bitcoin will result in a decrease in the index.

On the other hand, if there is an unexpected increase in volatility, accompanied by a rise in the price of Bitcoin, it will result in an increase in the index.

2. 25% of the index is based on the market trend and its volume

The Bitcoin Fear and Greed Index measures the current volumes and market trend in comparison to the averages of the past 30 and 90 days.

A bearish market accompanied by a sudden increase in outgoing volumes will result in a decrease in the index.

On the other hand, if there is a bullish market with a sudden increase in incoming volumes, this will result in an increase in the index.

3. According to the index, 15% of the investors’ enthusiasm is measured through social media.

The index gathers and examines Bitcoin (BTC) mentions on various social media platforms, evaluating the frequency and extent of interactions over time.

An unusual increase in mentions of Bitcoin will result in a rise in the index.

4. 10% of the index tracks the variations in Bitcoin dominance

The index will interpret an increase in the dominance of Bitcoin as a sign of fear, perceiving it as a decrease in investments in more speculative and risky altcoins.

The index is based on the principle that an increase in Bitcoin’s dominance indicates a flow of capital towards the top cryptocurrency in the market as a protection against volatility .

On the other hand, if Bitcoin’s dominance decreases, it suggests that investors are becoming more greedy by investing in riskier cryptocurrencies and hoping for bigger gains.

5. 10% of the index is composed of Google searches

The index utilizes Google Trends data on various queries related to Bitcoin. It examines the currently recommended and most popular searches as well as the changes in search volumes.

For instance, a significant rise in searches for “Bitcoin price manipulation” is seen as a sign of market fear and will result in a decrease in the index.

On the other hand, a significant increase in searches for “buying Bitcoin” is viewed as a sign of greed in the market and will result in an increase in the index.

6. 15% of the index is based on investors’ responses to various surveys

During the writing of this piece, this aspect is currently on hold, however it involves conducting weekly surveys on Bitcoin in collaboration with Strawpoll. These surveys gather the opinions of a group of investors, typically consisting of 2,000 to 3,000 participants per survey.

The opinions of investors will be considered in the calculation of the Bitcoin Fear and Greed Index. If the surveyed investors are optimistic, the index will approach 100. Conversely, if they are too cautious, the index will approach 0.

The Fear and Greed Index uses this data to calculate an overall indicator of market sentiment towards Bitcoin. Although this article focuses on the Fear and Greed Index for Bitcoin, similar indices also exist for many other assets.

How to interpret the Crypto Fear and Greed Index?

It is important to note that the sentiment index is simply an indicator. It can be easy to misunderstand.

In reality, when the index shows “Extreme Fear”, it does not automatically mean that the market has reached its lowest point.

Similarly, when the index shows “Extreme Greed”, it does not automatically mean that the market has reached a peak.

As demonstrated in the above graph, which displays the periods of “Extreme Fear” in red and “Extreme Greed” in green in the Bitcoin (BTC) market, they do not precisely align with the market’s lowest and highest points.

The crypto-currency fear and greed index is a valuable tool for understanding market emotions, but it should never be the only element influencing your trading choices.

The most effective way to utilize this index is to combine it with a method that identifies the convergence of various signals through graphical analysis and multiple indicators.

Have you already used this tool ?

Tell me in the comments !

Source : Crypto Fear and Greed Index

David Crypto

One Response